Tax Identification Number (TIN) is an essential document for individuals and businesses involved in any financial transaction in Bangladesh. It serves as a unique identifier for taxpayers and facilitates tracking of income and tax payments by the National Board of Revenue (NBR).

E-TIN certificate is essential for individuals and businesses to conduct various financial transactions and fulfill their tax obligations. In this article, we will walk you through the step-by-step process of Create an e-TIN certificate online and e-TIN registration in Bangladesh.

What is an e-TIN Certificate?

An e-TIN certificate is an electronic version of your TIN certificate issued by the NBR. It holds the same legal validity as a physical certificate and grants access to various online tax services provided by NBR. Obtaining an e-TIN certificate simplifies tax filing, reduces paperwork and facilitates communication with tax authorities.

Who Needs an e-TIN Certificate?

Anyone in Bangladesh engaged in financial activities, including:

Person:

- Salaried individuals exceed a certain annual income threshold.

- Individuals who receive income from rental property, investments, or freelance work.

- Persons seeking business licenses or permits.

Businesses:

- Sole Proprietorship, Partnership and Limited Company.

- Business importing or exporting goods.

- Businesses participating in government tenders or contracts.

Benefits of getting an e-TIN certificate

- Benefits: Apply and access your e-TIN certificate online, eliminating the need for physical visits to tax offices.

- Efficiency: Simplifies tax filing by submitting tax returns online.

- Transparency: Enables easy access to your tax information and communication with NBR.

- Reduced Paperwork: Eliminates the need for paper-based tax forms and certifications.

- Compliance: Meets legal requirements for individuals and businesses engaged in financial activities.

Condition for E-TIN Registration

Before starting the online registration process, make sure you have the following:

- Valid NID or Passport: This is a mandatory requirement for verification purposes.

- Mobile Phone Number: A valid mobile phone number is required to receive the One-Time Password (OTP) used for verification during registration.

- Email Address: An active email address is essential for notifications and communications from NBR.

- Basic Information: Prepare details about yourself or your business, including legal name, address, contact information and relevant business information (if applicable).

How to Create an e-TIN Certificate Online? Step by Step Process

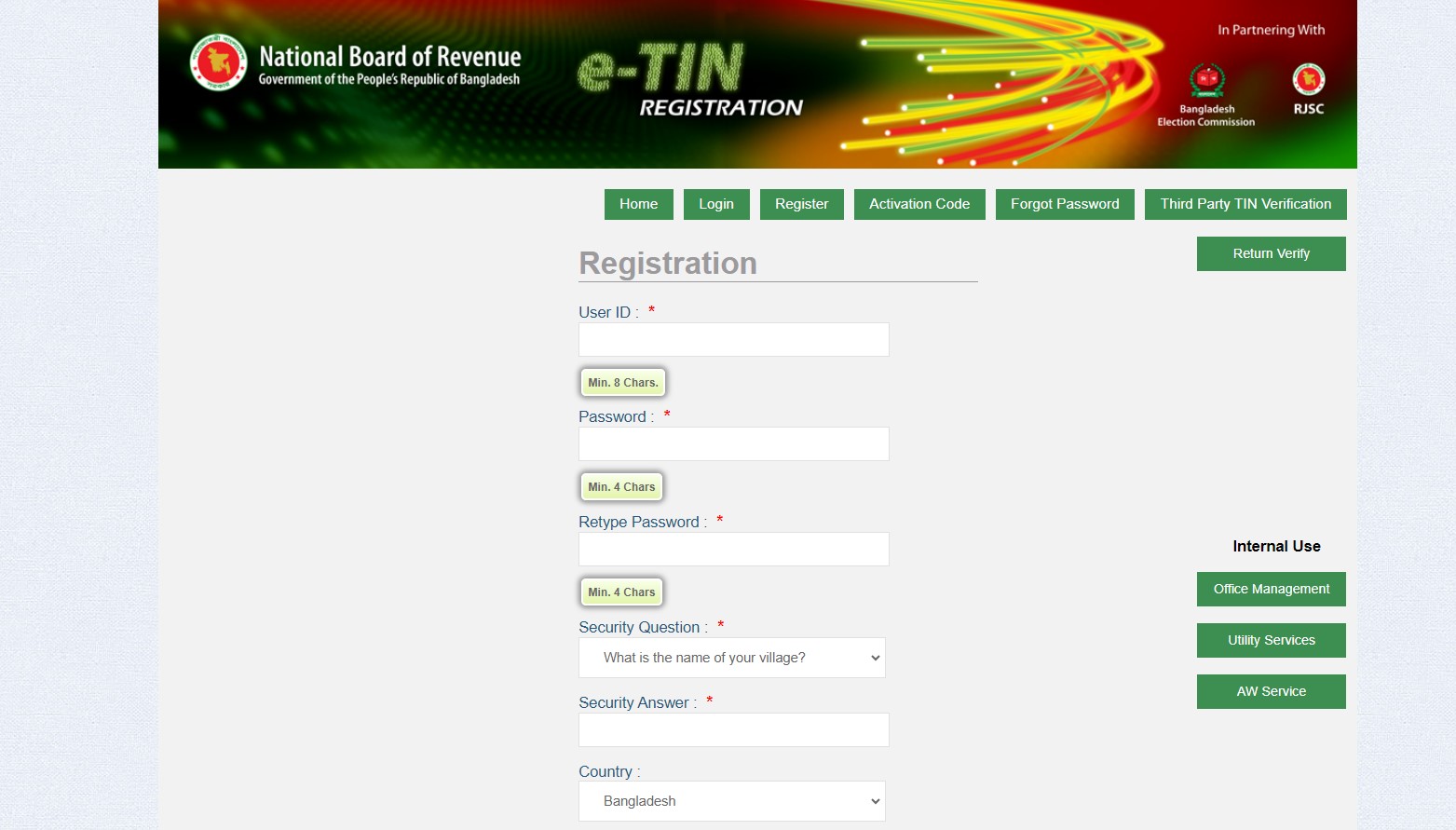

Visit the e-TIN Registration Portal:

- Visit NBR’s official e-TIN registration portal at https://secure.incometax.gov.bd/TINHome.

Create a User ID:

Click on “Registration“ option.

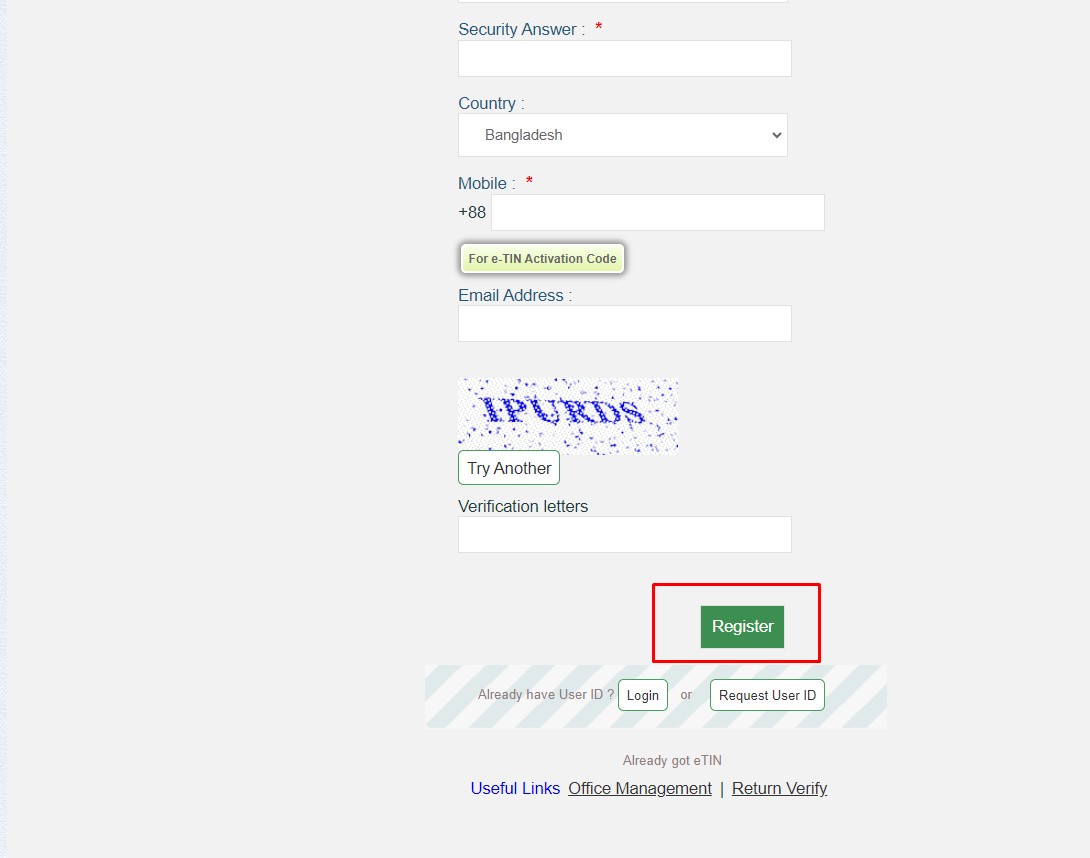

- Fill up the all Empty Box. Create your USER ID, Password, Security Question & Answer, Country, Mobile & Email Address.

- Solve the captcha and click on “Register”.

Verify Your Information:

- You will receive an OTP on your registered mobile phone number and email address. Enter both the OTPs in the prescribed fields in the portal and click on “Verify”.

Complete the Registration Form:

- Fill the online registration form carefully with your personal or business details as required.

- Ensure that all information is correct and matches your NID/passport data.

- Provide details such as name, address, phone number, taxpayer type, source of income (if applicable), and business information (if registered for business).

Submit the Application:

- Once you have verified complete and all information, carefully review the details for accuracy.

- Click on the “Submit Application” button to start processing your e-TIN application.

Print Acknowledgment Slip:

- After submission, the system will generate an acknowledgment slip with a unique application reference number.

- Print the slip for your records as it may be required for future reference.

Track the Application Status:

- You can track the status of your application by logging into your account on the e-TIN portal using your registered ID and password.

- The application is usually verified by the NBR, which may take several working days.

Download the e-TIN Certificate:

- Once your application is approved, you will receive a notification via email and SMS.

- Log in to your account and Tab to the “Download Certificate” section.

- Download your e-TIN certificate in PDF format and save it safely.

By Following these process you can create your e-TIN certificate & Download It very easily.

Final Thought

Creating an e-TIN certificate online and completing e-TIN registration in Bangladesh is a simple process that offers many benefits to taxpayers. By following the step-by-step guidelines mentioned above, individuals and businesses can obtain their e-TIN certificate conveniently and efficiently, enabling them to fulfill their tax obligations and access various government services with ease.